|

| ||||

| ►Affin Bank BR / BLR / BFR Historical Data | |||||

- Affin Bank Moratorium

- Affin Bank Fixed Deposit Promotion

- Bank Fixed Deposit Rates

- Affin Bank Online Banking

AFFIN Group is a major home-grown financial services conglomerates. The Group's primary activities focus on the provision of commercial, islamic and investment banking services, money broking, fund management, underwriting of general and life insurance business.

Fixed Deposit Rate for all banks in Malaysia – November 2019. Let’s check out the promotions offered by the banks. Promotion November 2019 – Bank Offer RHB Bank 2. Standard Chartered Credit Cards from Affin Bank Previous Slide ︎ Next Slide ︎ Affin Bank World MasterCard Affin Bank BHPetrol 'Touch & Fuel' MasterCard Contactless Affin Bank Touch. How Does A Fixed Deposit Account Work? In a typical FD arrangement, you place a sum of money into a bank by cash or cheque, and receive in return a certificate of deposit indicating the deposited amount. Affin Bank Berhad 1 Year Fixed Term Deposit Rate indicated is the Fixed Deposit Interest Rate for Counters. The rate of 4.05% is 0.65% higher than the average 3.4%. Also it is the highest rate for this. Terms & Conditions apply. Congratulations to our winners! For more information, call 03-8230 2222; visit your nearest AFFIN BANK or log on to www.affinonline.com for full terms and conditions. Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only. Below from Affin Good morning Our latest Affin Bank FD promotion rate as below.

The prominent shareholder of AFFIN Holdings Berhad is Lembaga Tabung Angkatan Tentera, the nation's premier superannuation fund manager for the armed forces.

Affin Bank is a commercial bank with a network of 90 branches nationwide. The bank serve both retail and corporate customers. AFFIN BANK's wholly-owned Islamic banking subsidiary Affin Islamic Bank Berhad (AFFIN ISLAMIC) offers a complete range of Syariah-compliant financial products and services.

Affin Home Solutions is the ideal choice for you. It is more than just a home loan, it will help you manage your finances, upgrade your home and save interest costs.

Got any question on BLR or Base Rate? Contact Affin Bank Call Center: +603 5522 3000 or visit any of your nearest Affin Bank branch.

Effective Lending Rate Find out more information on Effective Lending Rate. |

| Financial Products: | ||

| • Savings Account | • Home Loan / Mortgage Loan | • Islamic Banking |

| •Current Account | • Personal Loan | • Share Margin Financing |

| • Fixed Deposit Account | • Hire Purchase (Car Loan) | • Premier Banking |

| • Foreign Currency Account | • Term Loan | • Bancassurance |

| • Remittance Services | • Study Loan | • ASB Financing |

| • Overdraft Facility (OD) | • Charge Card | • Unit Trust |

| • Trade Finance | • Credit Master Card | |

| • Contract Financing | • Credit Visa Card | |

| • SME Financing | • Debit Card | |

| Related Information: |

| •BNM keeps OPR at 1.75%- 4 March 2021 |

| •Latest Base Rate |

| • Guide to consumer on Base Rate |

| • FAQs on Base Rate (BR) |

| •Base Rate vs BLR |

| • BLR Comparative Table |

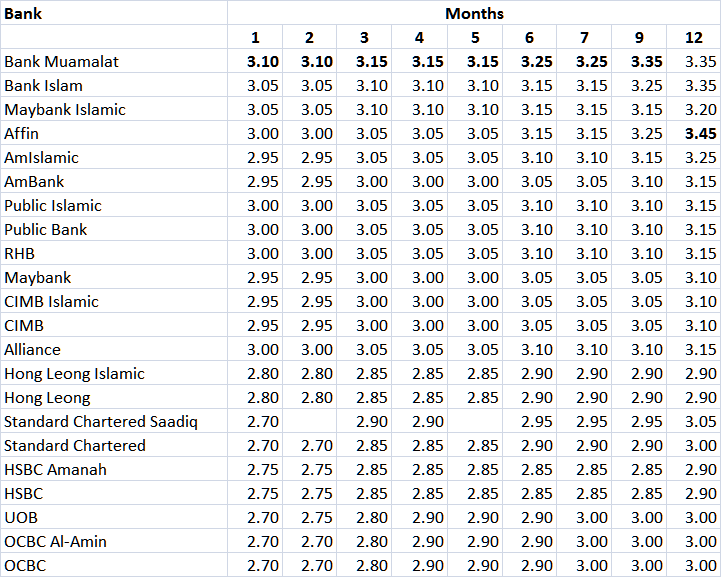

According to Trading Economics and Bank Negara Malaysia, the average overnight policy rate in Malaysia is 1.75%. This means, most of the regular fixed deposit rates in Malaysia would be 1.75% and below. This is a 1.5% drop from the recent high average fixed deposit rate of 3.25% in 2019.

Don’t worry, there are FD promo rates this Chinese New Year!

Here's an overview of the rates:

1) Affin Bank

For this promo, the customer is required to open and maintain a current or savings account to qualify for the special rates.

Minimum deposit: RM10,000 (RM9,000 in FD and RM1,000 in current or savings account)

Maximum deposit: – RM1 million (RM900,000 in FD and RM100,000 in current or savings account)

Affin Bank Moratorium

More details here: Affin Bank

2) Alliance Bank

To qualify for the special rates of up to 20.21% for the first month of deposit, one has to maintain an investment in selected unit trust funds or purchase Banca Regular Premium products.

Minimum deposit: RM1,000

Maximum deposit: None

More details here: Alliance Bank

3) CIMB eFixed Deposit

The campaign is only available on Clicks web/desktop view.

More info: CIMB eFixed Deposit

4) HSBC Premier

Enjoy special rates of up to 6.38% per annum on Term Deposit-i with a minimum placement of RM50,000.

More info: HSBC Premier

5) Hong Leong

The FD could be placed online, so you can enjoy the special rate without going out!

More info: Hong Leong FD Promotion

6) Public Bank eFD

More info: PB eFD via FPX Campaign

Affin Bank Fixed Deposit Promotion

Share with your friends and family to make extra risk-free returns this Chinese New Year!

Bank Fixed Deposit Rates

Disclaimer: The information stated is not intended to be and does not constitute financial advice, investment advice, or trading advice.